SK Hynix to Buy Intel’s NAND Memory Business For $9 Billion

by Ryan Smith on October 20, 2020 9:30 AM EST

In a joint press release issued early this morning, SK Hynix and Intel have announced that Intel will be selling the entirety of its NAND memory business to SK Hynix. The deal, which values Intel’s NAND holdings at $9 billion, will see the company transfer over the NAND business in two parts, with SK Hynix eventually acquiring all IP, facilities, and personnel related to Intel’s NAND efforts. Notably, however, Intel is not selling their overarching Non-Volatile Memory Solutions Group; instead the company will be holding on to their Optane memory technology as they continue to develop and sell that technology.

Per the terms of the unusual agreement, SK Hynix will be acquiring Intel’s NAND memory business in two parts, with the deal not expected to completely close until March of 2025. Under the first phase, which will take place in 2021 once all relevant regulatory bodies have approved the seal, SK Hynix will pay Intel the first $7 billion for their SSD business and Intel’s sole NAND fab in Dalian, China. This will see Intel’s consumer and enterprise SSD businesses transferred to SK Hynix, along with the relevant IP and employees for the SSD business, but not any NAND IP or employees. Similarly, while SK Hynix will get the Dalian fab, the first phase does not come with the employees that operate it.

Following the first phase, Intel will continue to develop and manufacture NAND out of the Dalian fab for roughly the next four years. This period is set to last until the rest of the deal fully closes in March of 2025. At that point, SK Hynix will pay Intel $2 billion for the rest of their NAND business. This will finally transfer all of Intel’s NAND IP and related employees over to SK Hynix, along with the Dalian fab employees. Intel and SK Hynix have not offered any explanation for the prolonged acquisition, so we’re hoping to find out a bit more with the companies’ relevant earnings calls this week.

Meanwhile, Intel will continue to hold on to their Optane memory business. Optane is considered a “platform differentiator” by the company, as Intel intends to continue leveraging the technology for their unique, high-capacity NV-DIMMs. Accordingly, Intel has announced that they will be continuing to develop the underlying 3D XPoint technology and sell products based on it, which is consistent with their long-term aspirations of making Optane its own tier in the memory/storage hierarchy.

Overall, selling off their NAND business is a big step for Intel, a company that started out making memory. But it’s not entirely unexpected, as Intel has never been quite as successful with their NAND business as they would have liked. And the core of the company’s NAND efforts, their longstanding IMFT joint-venture with Micron, started winding down in 2018 when the two companies announced that they would stop jointly developing flash memory.

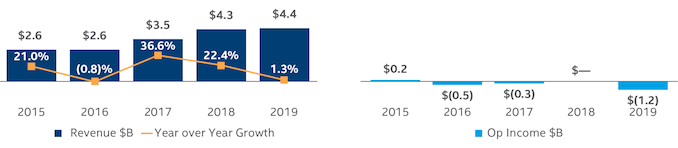

Since then, Intel has largely been walking its own path, securing the #5 spot in the NAND industry (generally right behind #4 SK Hynix) and releasing new products, but struggling with the commodity nature of the NAND business. While Intel’s Non-Volatile Memory Solutions Group (NSG) as a whole brought in $4.4B in revenue for 2019, the group has lost money for 4 of the last 5 years, recording flat or negative operating incomes. Only in the last six months has Intel made any real money off of NAND, reporting $600M in operating income for the first half of 2020. So although NSG – and by large part, Intel’s NAND business – have played a big part in Intel’s record revenues, they haven’t turned a significant profit for a company that’s renowned for their 60% gross margins.

Intel NSG Revenue and Operating Income, 2015-2019

Meanwhile for SK Hynix, the Intel deal opens the door to some new opportunities, and it also helps formerly fourth-place company company scale up to deal with the competition of its three remaining rivals, Samsung, Kioxia/WD, and Micron. TrendForce estimates that once this deal closes, SK Hynix will become the second-largest vendor of NAND, with over 20% market share, placing it behind market leader (and rival Korean firm) Samsung. Like many other commodity component markets, the NAND flash market has been subject to wild swings in profitability and the resulting pressure to consolidate, so by picking up Intel’s NAND business, SK Hynix will be in a stronger position going forward.

But the real pearl for SK Hynix is Intel’s enterprise SSD business, which the company specifically calls out in its joint press release. Despite its overall modest size, Intel’s NAND business has a major presence in the enterprise SSD market thanks to its early investment there as well as its domination of enterprise CPU sales. Intel’s chief (and arguably only serious) competitor in this space has been Samsung, so acquiring Intel’s SSD business makes SK Hynix that much more capable of going toe-to-toe with their biggest rival.

Long term, however, it remains to be seen what SK Hynix will do with the NAND fab side of Intel’s business. While it’s clear that they have big plans for SSDs and intend to leverage Intel’s existing market share and customer relationships – which is a big part of why they’re acquiring that segment first – SK Hynix doesn’t necessarily need Intel’s NAND manufacturing technology. SK Hynix is plenty capable of building more fabs on its own if it wanted more raw NAND capacity, and indeed the company has undergone several expansions. Meanwhile the companies’ technologies are significantly different, as Intel relies on floating gate tech while SK Hynix uses charge trap tech. So although the two technologies have their trade-offs, it’s very questionable whether SK Hynix wants to continue developing both over the long run.

And for both parties, the long run really is the key. NAND flash is still facing a likely dead-end in the long run, as NAND has been scaled down almost as small as it can go before leakage becomes a serious problem. 3D NAND stacking has given NAND a second wind in the interim, but there’s only so far that can go, especially in respect to reducing bit costs. Which is a big part of the reason why Intel developed 3D XPoint to begin with, as the technology doesn’t suffer the same scalability restrictions. So although Intel is getting out of the NAND game, they are still very much in the storage game over the long run, now focused on a non-volatile memory technology that is expected to scale much further in the future.

Speaking of the future, Intel has also stated that they will be investing the expected proceeds from the sale into some of their other non-core, forward-looking businesses. Intel’s 5G, AI, and edge efforts are all slated to benefit from the sale, and all are markets that Intel is priming for potentially extreme growth over the coming years.

In the interim, however, the next step will be up to regulators. SK Hynix’s acquisition will need the approval of American, South Korean, and Chinese regulators, which the companies expect to take around a year – and at which point SK Hynix can start the actual acquisition. Meanwhile Intel is set to announce its Q3 earnings this Thursday, at which point we may hear a bit more about the deal from Intel’s perspective. SK Hynix’s own earnings call will follow in a couple of weeks, on November 3rd.

Source: SK Hynix & Intel

64 Comments

View All Comments

Teckk - Tuesday, October 20, 2020 - link

While I think this might work well for Intel in the long run. So, Intel employees will work in the Dalian fab which will be owned by SK Hynix till 2025? This will be revenue recognized for SK Hynix starting next year? Also, surprising that Micron didn't want to take this up considering they have worked with Intel previously.Billy Tallis - Tuesday, October 20, 2020 - link

Micron wouldn't have much reason to be interested. They already dissolved the IMFT partnership because Micron and Intel disagreed on where they wanted to go with flash R&D. Micron might be able to benefit somewhat from Intel's in-house SSD controller IP, but I'm not sure that's reason enough for them to acquire flash tech they already turned down.5080 - Tuesday, October 20, 2020 - link

Seems like a bad deal without the inclusion of the Optane business. NAND is a constrained commodity now with market saturation, too many competitors resulting in falling profits. Not a business I would invest heavily into.Arsenica - Tuesday, October 20, 2020 - link

If SK sees the deal as getting rid of a competitor it may be worth to them. Intel's position in the datacenter SSD market is also valuable.I'm guessing that Intel will keep its plan to keep developing Optane products in their New Mexico fab.

trivik12 - Tuesday, October 20, 2020 - link

There is no way Intel will sell Optane. That is a diffrentiating product for their servers. Its more than just a stand alone product.SK bought Intel NAND for basically Enterprise customer base. Their ruler SSD's are used in most DC. SK can continue to thrive in that market.

BedfordTim - Tuesday, October 20, 2020 - link

I imagine the reason for the stretched out deal, is that it protects SK Hynix against potential US sanctions. A US attack on the fab is a risk they were probably not willing to take.mitsuhashi - Thursday, October 22, 2020 - link

No disrespect but I really doubt fear of sanctions were a significant part of the purchase. South Korea and Taiwan's huge place in semiconductors and their status as US allies is precisely what allows Trump to sanction Chinese tech firms. Sanctioning Korea would mean sanctioning Samsung and LG in addition to SK which would make the world suddenly very, very, very short on critical necessities like RAM, processors, and displays. And then the US would also be forcing these firms to hold hands with China. Terrible option.Billy Tallis - Thursday, October 22, 2020 - link

I think he was referring to the possibility of US sanctions against China affecting the fab in Dalian, China that SK hynix is buying from Intel.Kangal - Saturday, October 24, 2020 - link

Yeah, I can't help but feel Intel ripped-off SK Hynix with this transfer.$9 Billion seems stupid when you realise Intel isn't that strong of a competitor in the flash market, especially when Optane is not included in the deal. The only reason I can think of the price being so high is because 1- Intel is greedy and needs the money for R&D to battle Zen3.

The 2- second reason, is probably they can insure sanctions against China doesn't happen for SSDs because of this one deal. Whilst, SK Hynix is a South Korean corporation and not Chinese, this fab is located in Northern China. On this point we can only speculate. A wild conspiracy theory would be that they want the IP from Intel's SSD division to be transferred to Mainland China, even if done so by proxy allied corporation. The recent ImaginationTechnologies (PowerVR) deal does bring up the realities of such scenarios.

PandaBear - Friday, October 30, 2020 - link

Intel has a strong enterprise SSD presence and SK Hynix doesn't. Intel's nand is old tech by now and I think that ESSD market share and know how is where SK want. The fab might be used for other future controller / old product for SK instead of nand.