Qualcomm Announces Major Workforce Restructuring With Q3 FY 2015 Results

by Brett Howse on July 22, 2015 7:25 PM EST- Posted in

- SoCs

- Qualcomm

- Financial Results

At one point, it seemed like Qualcomm would become the ARM equivalent to Intel in the x86 space. Their Snapdragon processors, equipped with industry leading cellular technology, powered a huge number of devices. Practically every flagship phone of 2013 and 2014 (sans Apple of course) carried a Qualcomm processor inside. But even Intel makes some big missteps, and the Netburst era was certainly one, allowing AMD to provide a much better product. Unlike those days though, there are more than just two players in the ARM SoC space, and Qualcomm has been under some relentless competition (always the best kind) from Samsung at the high end with the Exynos 7420, and on the low end with companies like Mediatek and Rockchip going after the lower margin business.

It’s not fair to blame all of Qualcomm’s woes on one issue, but Qualcomm’s issues began when Apple made the surprise move to 64-bit. On the 32-bit side, Qualcomm had been using custom designed ARM cores, with the last evolution of that being the Krait 450 core in the Snapdragon 805. Krait performed well, but with the move to 64-bit, suddenly the industry felt that the need to check the 64-bit box on the spec sheet in order to compete. Since Qualcomm was not ready with their 64-bit custom core, they had to turn to the standard ARM designs with the A53 and A57 powering their 64-bit lineup. As a result, this affected their market differentiation and performance at the high end.

Qualcomm will finally be moving to FinFET with the Snapdragon 820, and with it will be the custom Kyro 64-bit core. This should be available in the latter part of 2015, and available in devices in early 2016.

But that is the future, and today Qualcomm released their Q3 FY 2015 results. Revenue for the company was $5.8 billion, down 14% from the $6.8 billion a year ago. Operating income was down a staggering 40% to $1.2 billion, and net income was down 47% to $1.2 billion. Earnings per share fell 44% to $0.73, with Non-GAAP EPS of $0.99 which actually beat expectations slightly.

| Qualcomm Q3 2015 Financial Results (GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | Sequential Change | Year-Over-Year Change | |

| Revenue (in Billions USD) | $5.8 | $6.9 | $6.8 | -15% | -14% |

| Operating Income (in Billions USD) | $1.2 | $1.3 | $2.1 | -8% | -40% |

| Net Income (in Billions USD) | $1.2 | $1.2 | $2.2 | +12% | -47% |

| Earnings per Share (in USD) | $0.73 | $0.63 | $1.31 | +16% | -44% |

For a company which at one point seemed certain to become the dominant player in the ARM SoC space, these numbers hit pretty hard. Incorporated companies have a fiduciary duty to their shareholders, and Steve Mollenkoft, CEO of Qualcomm, today announced a major restructuring of the company which will see the company shed up to 15% of its workforce. It intends to save $1.1 billion annually through a series of targeted layoffs which will impact their temporary workforce, engineering, and reducing the number of offices. It is also reducing the annual share-based compensation by around $300 million. These cuts are expected to be complete by the end of fiscal year 2016, for a savings of $1.4 billion annually.

| Qualcomm Q3 2015 Financial Results (Non-GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | Sequential Change | Year-Over-Year Change | |

| Revenue (in Billions USD) | $5.8 | $6.9 | $6.8 | -15% | -14% |

| Operating Income (in Billions USD) | $1.7 | $2.7 | $2.4 | -37% | -30% |

| Net Income (in Billions USD) | $1.6 | $2.3 | $2.5 | -31% | -35% |

| Earnings per Share (in USD) | $0.99 | $1.40 | $1.44 | -29% | -31% |

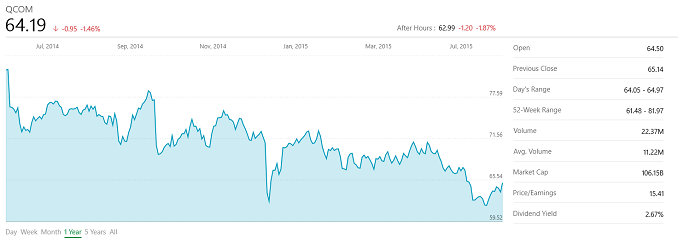

They will also be reviewing their corporate structure, capital return opportunities, and other alternatives with the goal of creating stockholder value. Qualcomm’s shares have fallen in price around 20% in the last year. They also have reaffirmed their commitment to return significant capital to shareholders, with a minimum of 75% of free cash flow being returned through dividends and share repurchases, in addition to the $10 billion stock repurchase program which was already underway. The board has also seen a shakeup, with two new members being added and they intend to appoint one additional independent director to the board. The company executives will also have additional return-based metrics for compensation.

Ultimately there is a lot of pressure on Qualcomm from some of its larger investors to split the company's highly profitable licensing business and their riskier chip development business, and this is something Qualcomm will be evaluating. In good times the chip business contributes significantly to Qualcomm's fortunes, but by its nature it's not as regular or profitable as Qualcomm's licensing efforts, and given the competitive landscape Qualcomm is in, investors are pushing a split as a means of allowing them to only invest in the licensing business and not be exposed to the chip business as well. Qualcomm for their part has stated that they are investigating this option, though whether it actually comes to pass remains to be seen.

All seems pretty rough for Qualcomm, but in the end they were still profitable, although not as profitable as they would like to be. MSM chip shipments were actually flat year-over-year with 225 million SoCs shipped. The initial 64-bit era has not been overly kind to Qualcomm though, and with their custom core being around six months away still, they have some work to do in the interim to avoid a repeat with the next SoC refresh.

Source: Qualcomm Investor Relations

36 Comments

View All Comments

rstuart - Wednesday, July 22, 2015 - link

One bad mistake when designing a memory controller, and it all turns to shit. Life is tough when you are an engineer.The response to the financial markets made me laugh. The problem lies within the Engineering team. Or probably more correctly lay within the engineering team, as there are so many bloodied noses I'm sure the lesson has been rammed home and it won't be forgotten for a long time. Yet did what did the CEO say?

> reviewing their corporate structure, capital return opportunities, and other alternatives with the goal of creating stockholder value ... have reaffirmed their commitment to return significant capital to shareholders, with a minimum of 75% of free cash flow being returned through dividends and share repurchases

Right. That's a sure certain to fix.

ikjadoon - Wednesday, July 22, 2015 - link

"The problem lies within the Engineering team".We have this discussion every time some company makes a foul up. Was it management pressuring engineers to meet "market demands" or engineers fouling up?

Please, everyone, continue to armchair-speculate what *really* happened...

edzieba - Thursday, July 23, 2015 - link

Given the move to 64bit cores was for a spec sheet feature rather than actual functionality, it's not hard to guess where the push for it came from.AndrewJacksonZA - Thursday, July 23, 2015 - link

+1 ikjadoonSamus - Thursday, July 23, 2015 - link

The management and marketing team screwed up by not properly evaluating market demands or predicting the next "trend"If the engineering team wasn't instructed to make a 64-bit chip, how is it their fault? If the engineering team made a faulty 64-bit chip, then it would be their fault.

icrf - Wednesday, July 22, 2015 - link

This is what I hate about the stock market. Vocal shareholders freak out after a quarter or two of issues. Lay off what gives the company value six months before seeing how well they did and if you need them, and take the pile of money the company has and put it anywhere except into the company (ie, shareholders).I don't want to own a stock for six months. I want to own it for six years, and I'm okay with the value tanking along the journey, just make the company better in the process and pay me off when times are good. I'm worried they could be the Intel of the ARM space, but short sighted moves like this will kill them.

If, on the other hand, they over expanded when times were good and this is just an adjustment back to what's actually needed, then that's another matter entirely. It doesn't sound like that, though.

iWatchHogwash2 - Thursday, July 23, 2015 - link

That's a thoughtful observation, good one.Nagorak - Thursday, July 23, 2015 - link

On top of that, the idea of breaking up the company is incredibly stupid. You take a profitable, but erratic chip making unit and put it on its own and what is going to happen? All it takes is a couple blunders and they go the way of AMD. The more stable income componet helps maintain the chip making unit during tough times, so it can turn things around.Samus - Thursday, July 23, 2015 - link

I agree, Qualcomm's "risky" chip business needs the stable income of the licensing business in order to weather the bad times.What the hell ever happened to the concept of corporate diversification?

Ananke - Thursday, July 23, 2015 - link

Corporate diversification is done through capital portfolio diversification, i.e. the shareholders will have investment in chip making and licensing only corporation, and will sell one of these if they don't perform.Unfortunately, in the long run this is not competitive strategy against Chinese government backed companies or vertical integrated Koreans like Samsung.

RIP Qualcomm...and all fabless businesses actually. Fabless is not competitive globally.