AMD Quarterly Earnings Report Q2 FY 2019

by Brett Howse on July 31, 2019 12:20 AM EST- Posted in

- CPUs

- AMD

- Financial Results

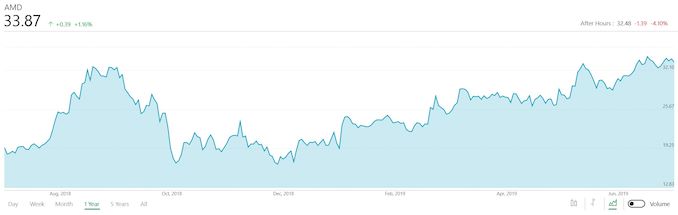

AMD announced their second quarter earnings for the 2019 fiscal year, and the company’s revenue was $1.53 billion for the quarter. This is down 13% from the same quarter last year. Gross margin improved from 37% to 41% year-over-year. Operating income was $59 million, down from $153 million a year ago, and net income was down $81 million to $35 million. This resulted in earnings-per-share of $0.03.

| AMD Q2 2019 Financial Results (GAAP) | |||||

| Q2'2019 | Q1'2019 | Q2'2018 | |||

| Revenue | $1531M | $1272M | $1756M | ||

| Gross Margin | 41% | 41% | 37% | ||

| Operating Income | $59M | $38M | $153M | ||

| Net Income | $35M | $16M | $116M | ||

| Earnings Per Share | $0.03 | $0.01 | $0.12 | ||

Although AMD was in the black for yet another quarter, this is certainly a dip that AMD does not expect to last. Their forecast for Q3 2019 is a 9% year-over-year increase in revenue to $1.8 billion, and they’ve recently launched new products that could help them achieve those goals.

| AMD Q2 2019 Computing and Graphics | |||||

| Q2'2019 | Q1'2019 | Q2'2018 | |||

| Revenue | $940M | $831M | $1086M | ||

| Operating Income | $22M | $16M | $117M | ||

Looking back at Q2 though, Computing and Graphics revenue was down 13% to $940 million, and AMD attributes this drop to lower graphics channel sales. This drop was slightly offset though by higher client CPU and datacenter GPU sales. Also good for AMD and their investors is that their average selling price for client processors has increased thanks to more Ryzen sales, and GPU average selling price has also increased thanks to datacenter GPU sales. The Computing and Graphics segment had an operating income of $22 million for the quarter, compared to $117 million a year ago.

| AMD Q2 2019 Enterprise, Embedded and Semi-Custom | |||||

| Q2'2019 | Q1'2019 | Q2'2018 | |||

| Revenue | $591M | $441M | $670M | ||

| Operating Income | $89M | $68M | $69M | ||

AMD’s other major segment is their Enterprise, Embedded, and Semi-Custom, and this product group also saw revenues fall 12% to $591 million for the quarter. AMD attributes this drop to lower semi-custom product revenue, which you can more or less read as console sales, and that makes sense since the current generation consoles are reaching the end of their life, but both Microsoft and Sony have both committed to AMD platforms for their next generation consoles, so expect this segment’s fortunes to get a bit better soon. Operating income was $89 million for this group, which was up from $69 million last year. The higher operating income is thanks to higher EPYC processor sales, which is also a great sign for this segment.

Although this quarter’s revenue certainly saw a dip, AMD did just launch their latest third generation Ryzen this month, which wouldn’t be reported in their Q2 earnings which ended June 29th. As we saw in our review, this is a great step forward for AMD’s processor designs, and they have also launched their Navi based GPUs in July, so it makes some sense to see a dip prior to a major product launch. We’ll keep our eye on their results for Q3, but as previously mentioned they are expecting this to be a short-term drop, and with their new product lineup, that seems like a safe bet.

Source: AMD Investor Relations

113 Comments

View All Comments

ballsystemlord - Friday, August 9, 2019 - link

Addendum: A 16 core EPYC (7282), is cheaper then the 16 core ryzen! If only EPIC were overclockable....Korguz - Saturday, August 10, 2019 - link

:-) i wouldnt mind playing with one of the 64 core epyc's my self :-)