Qualcomm to Acquire NUVIA: A CPU Magnitude Shift

by Andrei Frumusanu on January 13, 2021 8:30 AM EST

Today Qualcomm has announced they will be acquiring NUVIA for $1.4bn – acquiring the start-up company consisting of industry veterans which originally were behind the creation of Apple’s high-performance CPU cores. The transaction has important ramifications for Qualcomm’s future in high-performance computing both in mobile, as well as laptop segment, with a possible re-entry into the server market.

NUVIA was originally founded in February 2019 and coming out of stealth-mode in November of that year. The start-up was founded by industry veterans Gerard Williams III, John Bruno and Manu Gulati, having extensive industry experience at Google, Apple, Arm, Broadcom and AMD.

Gerard Williams III in particular was the chief architect for over a decade at Apple, having been the lead architect on all of Apple’s CPU designs up to the Lightning core in the A13 – with the newer Apple A14 and Apple M1 Firestorm cores possibly also having been in the pipeline under his direction.

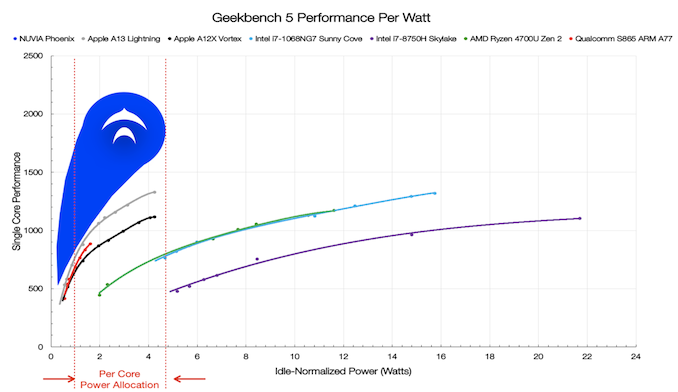

NUVIA had been able to recruit a lot of top industry talent from various CPU design teams across the industry, and had planned to enter the high-performance computing and enterprise market with a new server SoC with a new CPU core dubbed “Phoenix”.

NUVIA particularly had made aggressive claims about how their design would be able to significantly outperform the competition both in raw performance and power efficiency once it came to market – usually such claims are always to be taken with scepticism, however due to the members of the design team and talent having proven themselves in the form of Apple’s very successful CPU microarchitectures, there’s a lot more weight and credibility to them compared to other start-ups.

As a new entity in the industry, the company always had an uphill battle against the established giants, so even though they could have had talent and the technology, it’s not a guarantee that they would have been successful in business. I admit that the during the initial company announcement back in 2019 I did think to myself that it would have been possible that the team is looking to get acquired by another big player, which ended up happening today.

Qualcomm’s Gain and Possibilities

Qualcomm’s purchase of the whole company for 1.4bn USD can very much be seen as an endorsement to NUVIA’s talent and claims, and could mark an important shift in the industry, vastly expanding the possibilities of the combined entities compared to as if they were separate entities.

From Qualcomm’s perspective, it’s a bit of a bitter-sweet deal that follows the company’s failed Centriq business which back in 2018 had taken critical blows and cancellations as the company had to cut costs and lay off significant amount of people amongst their data-center unit.

At the time, Qualcomm was still maintaining a custom CPU microarchitecture team for server SoCs, having a few years earlier abandoned their efforts at custom CPUs for mobile, given Arm’s more power efficient and better PPA (Performance, Power, Area) advantages of licensable Cortex cores. Eventually the design teams fizzled out with the years, leaving Qualcomm no longer having the capability to design custom CPU microarchitectures, on top of them also never being all that competitive.

Qualcomm now acquiring NUVIA gives them the possibility to take advantage of the start-up’s early work in the server space, possibly reinvigorating the company’s ambitions in the server space, and giving them a second shot at the market. It’s to be noted however that in today’s press release about the acquisition there had been no mention of server or enterprise plans.

Furthermore, the move also has larger repercussions in the consumer space, with Qualcomm claiming that NUVIA CPU designs are expected to be deployed in flagship mobile SoCs and next generation laptops, as well as other industrial applications such as digital cockpits and ADAS.

In essence, Qualcomm is looking to leverage NUVIA’s CPUs to replace Arm’s current Cortex CPU IP and gain a competitive advantage in terms of performance. This is an important point of the transaction as it means that Qualcomm has confidence that NUVIA’s CPU designs and roadmap would be competitive or exceed that of Arm’s offerings, and put forth the money and investment towards those goals.

There’s also two more aspects in Qualcomm’s consideration for the purchase: With Nvidia’s plans to acquire Arm Holdings announced last September, this would give Qualcomm an important level of independence and safety in regards to their future product roadmaps – just in case Nvidia would make substantial changes to the CPU IP licensing model.

Secondly, Apple’s recent move to ditch x86 in favour of their own Arm-based Apple Silicon SoCs, starting with the new Apple M1 and planning to make a complete product transition in the coming 2 years has greatly pushed the Arm ecosystem forward. While Qualcomm to date has released laptop-specific Snapdragon designs, they still rely on Arm’s Cortex CPU IP and currently cannot compete with Apple’s silicon. In essence, Qualcomm could be viewing this as a large long-term bet at an attempt to establish themselves as the de facto Arm silicon supplier in this market segment, and alternative to Apple Silicon products. NUVIA in the past had commented that this would have been a possible long-term goal beyond their server space focus, however the acquisition by Qualcomm now vastly accelerate any such plans.

Press release:

SAN DIEGO, Jan. 13, 2021 /PRNewswire/ -- Qualcomm Incorporated (NASDAQ: QCOM) today announced that its subsidiary, Qualcomm Technologies, Inc., has entered into a definitive agreement to acquire NUVIA for approximately $1.4 billion before working capital and other adjustments. The transaction is subject to customary closing conditions, including regulatory approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

NUVIA comprises a proven world-class CPU and technology design team, with industry-leading expertise in high performance processors, Systems on a Chip (SoC) and power management for compute-intensive devices and applications. The addition of NUVIA CPUs to Qualcomm Technologies' already leading mobile graphics processing unit (GPU), AI engine, DSP and dedicated multimedia accelerators will further extend the leadership of Qualcomm Snapdragon platforms, and positions Snapdragon as the preferred platform for the future of connected computing.

...

NUVIA CPUs are expected to be integrated across Qualcomm Technologies' broad portfolio of products, powering flagship smartphones, next-generation laptops, and digital cockpits, as well as Advanced Driver Assistance Systems, extended reality and infrastructure networking solutions.

...

As part of the transaction, NUVIA founders Gerard Williams III, Manu Gulati and John Bruno, and their employees will be joining Qualcomm.

"CPU performance leadership will be critical in defining and delivering on the next era of computing innovation," said Gerard Williams CEO of NUVIA. "The combination of NUVIA and Qualcomm will bring the industry's best engineering talent, technology and resources together to create a new class of high-performance computing platforms that set the bar for our industry. We couldn't be more excited for the opportunities ahead."

In essence, the acquisition of NUVIA greatly increases Qualcomm’s future prospective in the mobile and consumer laptop market, with possible long-term positive repercussions for the company’s product’s competitiveness. We’re looking forward to see how this plays out over the next coming years.

78 Comments

View All Comments

mode_13h - Friday, January 15, 2021 - link

> as long as others aren't orders of magnitude better..., they don't have much to worry about.I don't know if they're exactly worried, but they're certainly suing him and could even seek an injunction to stop the acquisition.

Spunjji - Thursday, January 14, 2021 - link

Interesting! Not exactly great from a competition perspective, but probably a very good thing for the Nuvia tech itself to be attached to a company that will have no trouble at all bringing it to market.lmcd - Thursday, January 14, 2021 - link

Agreeing with the implicit part of your comment. If nothing else, it gets Nuvia access to a vital asset no one has mentioned: wafer agreements!Spunjji - Friday, January 15, 2021 - link

Exactly that - plus all the other stuff further down the line once they actually have a product fabbed, like developer and customer relations. A great product is no good if you can't persuade anyone to implement it in an OEM design!mode_13h - Thursday, January 14, 2021 - link

I think it's a positive development, especially since Apple's legal challenges might've rendered Nuvia too toxic for anyone else.Seriously, who else is doing custom ARM cores, at this point? They've been dropping like flies! I'm gladdened by the prospect that there will be at least one set of SoC's on the market with a non-Cortex ARM core (and I'm not counting Apple's, since those will surely remain locked in their walled-garden). Especially now that Nvidia owns ARM.

serendip - Thursday, January 14, 2021 - link

Apple did it because they control most of their own supply chain and they can set the prices accordingly. A chip vendor like Qualcomm can't sell many expensive high-end ARM chips to customers who won't take the risk of using those chips. Using ARM Cortex IP ends up being the lower cost, lower risk option for everyone from Qualcomm to Samsung to Huawei. Heck, even Ampere and Amazon use ARM cores because that's the lower cost and fastest method to get to market.Apple having its own CPU design arm allows it to undercut Intel pricing while prioritizing certain features for MacOS. Other ARM vendors have to focus on more general purpose platforms like Android and Windows.

Spunjji - Friday, January 15, 2021 - link

That's definitely one way to look at it! I'm mainly apprehensive because of how much of a lock Qualcomm already have on the ARM SoC market - if the Nuvia IP is as good as they claim then the remaining players may have trouble keeping up in anything other than a second-tier role.I still have my fingers crossed that the Nvidia/ARM deal gets knocked down; if it doesn't, then I think I'll probably hew closer to your take on this.

Meteor2 - Sunday, January 17, 2021 - link

Fujitsu.mode_13h - Monday, January 18, 2021 - link

I don't count them because, as far as I can tell, their cores were designed only for use in their HPC systems. That would basically put them in the same camp as Apple.I also think they took this approach more for political reasons than purely technical or economic, not wanting to be dependent on providers in any external country for the IP of their critical HPC infrastructure.

Meteor2 - Monday, January 18, 2021 - link

They're custom ARM cores. You didn't specify in which class.Fujitsu have produced the most power-efficient general purpose CPU-based HPC system to date; I would assume they chose the ARM ISA in order to realise that.