Intel Announces Q1 FY 2018 Results: Another Record

by Brett Howse on April 26, 2018 11:45 PM EST- Posted in

- CPUs

- Intel

- Financial Results

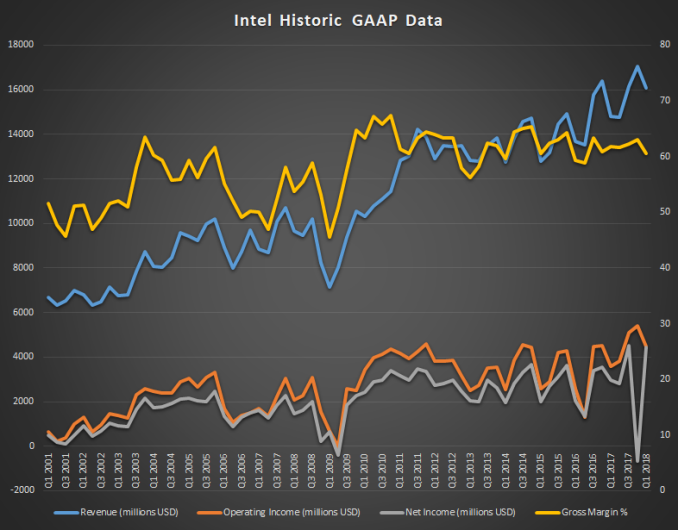

This afternoon, Intel announced their earnings for the first quarter of their 2018 fiscal year, and once again, the company has set new records, with revenue for the quarter of $16.1 billion, up 9% from a year ago. Intel is always a company built on strong margins, and although they were down 1.3% from last year, at 60.6% they are still quite strong. Operating income was up 23% to $4.5 billion, and net income was up 50% to $4.5 billion, which is the same as their operating income because they had gains on equity of $643 million, and they paid only 11.1% in taxes for the quarter. Earnings per share came in at $0.93, up 53%.

With numbers like that, it shouldn’t be a surprise that all of Intel’s business units improved their revenue year-over-year, including the Client Computing Group, which had revenues of $8.2 billion for the quarter, which was up 3%. It’s not a huge gain, but in a shrinking PC market, and stronger competition, they were able to scratch out some growth.

| Intel Q1 2018 Financial Results (GAAP) | |||||

| Q1'2018 | Q4'2017 | Q1'2017 | |||

| Revenue | $16.1B | $17.1B | $14.8B | ||

| Operating Income | $4.5B | $5.4B | $4.5B | ||

| Net Income | $4.5B | -$0.7B | $3.0B | ||

| Gross Margin | 60.6% | 63.1% | 61.9% | ||

| Client Computing Group Revenue | $9.0B | -8.9% | +3% | ||

| Data Center Group Revenue | $5.2B | -4.4% | +24% | ||

| Internet of Things Revenue | $840M | +3.5% | +17% | ||

| Non-Volatile Memory Solutions Group | $1B | +12.5% | +20% | ||

| Programmable Solutions Group | $498M | -12.3% | +17% | ||

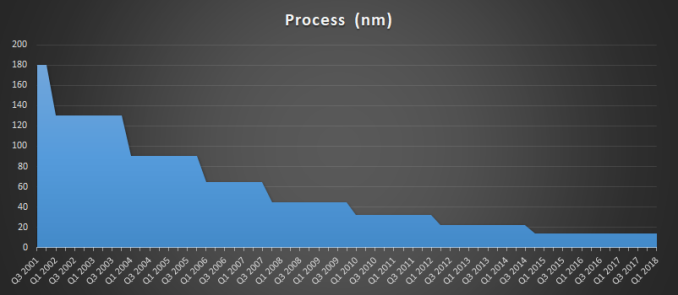

Ryan’s going to go more into this in another piece, but Intel also made it official that they are not going to have any volume shipments of 10 nm until 2019. Intel is currently shipping low-volume on 10 nm, but continued struggles in getting the new process up to speed mean that any 10 nm products that were in the works are now going to be delayed again. Intel is going to continue to improve their 14 nm node for this year.

Intel classifies the Client Computing Group as “PC-Centric” and you can see that it’s still the bread and butter of their revenue, but it’s also been stagnant for a while. They classify all of their other business as “Data-Centric” which includes the Data Center Group, IoT group, Non-Volatile Storage, Programable Solutions Group. This Data-Centric aspect is why Intel is growing again.

The Data Center Group had revenues of $5.2 billion, which is up 24% year-over-year. As we saw in AMD’s earnings, EPYC hasn’t really made an impact on their earnings yet, but Intel continues to dominate in this segment.

IoT is closing in on the billion-dollar revenue for a quarter, with growth of 17% year-over-year to $840 million. Although Intel missed out on mobile, IoT has the potential to quickly surpass mobile, and they’ve committed to this space early, and are seeing strong growth.

Non-Volatile Memory Solutions, which is Intel’s NAND flash and Optane group, had revenues of $1.0 billion for the quarter, which is up 20% year-over-year. They’ve focused a lot on the datacenter with their solutions, and there is higher margins there, so it’s not a surprise to see them focus in on that market.

Programmable Solutions had revenues of $498 million for the quarter, up 17% year-over-year. This is another strong growth segment for Intel, and we’ve seen a lot of the cloud infrastructure trying to find ways to offload work onto FPGAs in an attempt for more efficient workloads.

Thanks to the strong start, Intel has already raised their full-year expectations to $67.5 billion, which is an increase of $2.5 billion over their last forecast. Intel has traditionally led with their fabs, so it’s interesting to see them growing with such vigour when their fabs advances are completely stalled, but such is the growth of cloud computing.

Source: Intel Investor Relations

17 Comments

View All Comments

TEAMSWITCHER - Friday, April 27, 2018 - link

Look at that graph that shows the process size reduction (in nm) since 2001. Clearly you can't have transistor features less than 0 nm, so we are approaching an asymtote. Any increase in density from here on will be a victory hard fought.lefty2 - Friday, April 27, 2018 - link

"EPYC hasn’t really made an impact on their earnings yet"Funny that you should say that. In the earnings call they specifically mention "deceleration of DCG growth", because of "tougher competition going into the second half."

Brett Howse - Friday, April 27, 2018 - link

Key word being yet.eastcoast_pete - Sunday, April 29, 2018 - link

Agree, but posted earnings are, by definition, what happened in the past. Intel's stated caveat is about the already growing adoption of EPYC, which will take some of the sales from their Xeon lines. I just love that chipzilla will once again try a bit harder (invest more, improve faster, and -gulp- lower prices ) to get my money - good for me, good for us!Krysto - Friday, April 27, 2018 - link

How much of that is due to Trump's lower taxes = higher profits?Zingam - Sunday, April 29, 2018 - link

So the Meltdown warmed up their profit margins very well!Good make more bugs like that, Intel :)

dwade123 - Sunday, April 29, 2018 - link

Intel and Nvidia looks through AMD as if they don't exist. The majority of consumers don't even know AMD exists aside from a few vocal minority.